Options to reform the European carbon market

14 November 2012by eub2 -- last modified 14 November 2012

The European Commission is taking two important steps to address the growing supply-demand imbalance of emission allowances in the EU emissions trading system (EU ETS). As an immediate first step to address the rapid build-up of the surplus of emissions allowances, the Commission made a formal proposal to revise the auction time profile and delay ("back-load") the auctioning of 900 million allowances in the third phase of the EU ETS starting next year. The Commission also on 14 November adopted a report on the state of the European carbon market which sets out a range of possible structural measures that can be taken to tackle the surplus. The surplus of emission allowances has primarily built up because the economic crisis has reduced industrial emissions of greenhouse gases by more than anticipated, leading in turn to lower demand for allowances from businesses. The surplus is expected to continue in the third phase of the system, which will run from 2013 to 2020.

Advertisement

- Questions related to the proposed change in time profile for auctions: questions 2 – 11

- Questions related to the Carbon Market Report: questions 12 – 16

1 What has the Commission presented today regarding the EU emissions trading system (EU ETS)?

The Commission has adopted a report on the state of the European carbon market which shows that the carbon market is faced with the build-up of a large surplus of allowances, mainly because of the economic crisis. Not only does the magnitude of the surplus affect the EU ETS up to 2020 and beyond, but the rapid build-up is also of concern in the short term, i.e. in the transition from phase 2 (2008-2012) to phase 3 (2013-2020).

The report launches a debate on structural measures to sustainably address this large surplus and sets out six options for measures which could do so.

The report also underlines the need for the draft amendment to the EU ETS Auctioning Regulation (1) submitted by the Commission earlier this week as an immediate measure to tackle the rapid build-up of the surplus and improve the orderly functioning of the ETS. The amendment would postpone the auctioning of 900 million emission allowances from 2013-2015 to 2019-2020 (an approach known as 'back-loading'). The draft amendment has been sent to the EU Climate Change Committee, which has been invited to give its opinion before the end of the year.

2 Why should the timing of auctions within phase 3 be revised?

In 2012 and 2013, in the transition from phase 2 to phase 3, there is a large increase in the supply of allowances, both those allocated for free and those to be auctioned. This is partly due to the inclusion of new sectors and gases, but the supply of allowances and international credits is also expected to increase temporarily due to a number of specific factors linked to the transition from phase 2 to phase 3.

Together with reduced emissions due to the economic crisis, this results in the supply of allowances exceeding demand, leading to a surplus of allowances in the market. This surplus will rapidly increase in the transition to phase 3, and this could hamper the orderly functioning of the market. Changing the 'auction time profile' by reducing the volume of allowances auctioned early in phase 3 and correspondingly increasing it later on addresses this imbalance in the short term.

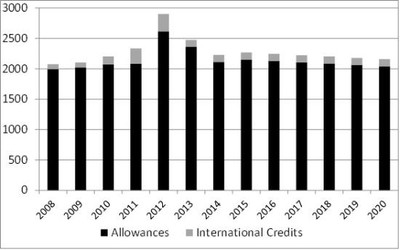

A graphical presentation of the evolution of allowances and international credits can be found below. The exact final allocation of allowances and the volume of credits used are subject to some uncertainty.

3 How many allowances should be back-loaded in 2013-2015?

The draft amendment to the Auctioning Regulation would reduce the volume auctioned by 900 million over the first 3 years of phase 3 (2013-2015) and increase it by the same amount over the last two years of phase 3 (2019-2020). This compares with an auctioning volume up to 2015 of more than 3.5 billion if no action were taken. (2)

4 Will back-loading affect the total number of allowances auctioned in phase three?

No, the total number of allowances auctioned in phase three is not changed by the back-loading proposal. Only the distribution of auction volumes over the period would change, with fewer allowances auctioned early in the period and more auctioned late in the period than currently foreseen.

5 Why did the Commission not submit a higher or lower amount?

The Commission has analysed the impact of back-loading 400 million, 900 million and 1.2 billion allowances. The analysis is shown in the proportionate impact assessment accompanying the draft amendment.

A higher amount of 1.2 billion allowances was found to increase the risk of significant upward pressures on prices early on in phase 3 and of a corresponding decrease late in phase 3. A lower amount of 400 million allowances would not sufficiently rebalance supply and demand early in phase 3.

Back-loading 900 million allowances is expected to have a more proportional impact, temporarily leading to a better balance between supply and demand and resulting in a more gradual build-up of the structural surplus, thereby reducing the risk of market price volatility in the transition to phase 3.

6 Will the auction calendar for 2013 already take into account a reduced auction volume?

The auctioning calendar determines in detail the dates and volumes of auctions throughout a year. The initial auction calendar for 2013 will be determined without taking into account the proposed back-loading volume for 2013. Following the adoption of the amendment to the Auctioning Regulation that provides for the backloading, the auction platforms (EEX and ICE) will update the 2013 auction calendars, reducing the volume for the remainder of the year. The 2013 auction calendars are still in preparation as the amount of allowances handed out free of charge is not determined yet, which is one of the elements for the Commission's estimate of the amounts of allowances to be auctioned. The Commission expects that EEX and ICE will be able to publish 2013 auction calendars by early December.

7 Were stakeholders consulted about back-loading?

Yes, an online stakeholder consultation was organised from 25 July 2012 to 16 October 2012. Relevant documents and contributions from stakeholders on the consultation

8 Is a change to the auction time profile not a market intervention?

The auction time profile is not decided in the primary legislation, i.e. the ETS Directive itself, but rather determined in the implementing legislation, i.e. the Auctioning Regulation. This means that the legislator saw merit in a more flexible decision-making process for the time profile, if deemed necessary, for example to address grave imbalances in exceptional circumstances. Changes to the auction time profile were therefore made possible in the Directive.

Using this limited flexibility should by no means be equated with market intervention. Furthermore this option still requires agreement through the Comitology process, involving Council and Parliament.

The Commission will use the option of changing the auction time profile only in exceptional circumstances, such as situations of artificial and large temporary imbalances. The present situation in the transition from phase 2 to phase 3 is one such circumstance, with supply outstripping demand not only due to lower than expected emissions but also because of regulatory aspects specific to the transition to phase 3.

9 Why has the Commission proposed a Council and Parliament Decision to clarify the ETS Directive and what is needed to adopt this Decision?

The Commission is proposing a change of the auction time profile for phase 3 allowances. This is done by amending the Auctioning Regulation. The Regulation has already been amended once to allow the early auctioning of 120 million phase three allowances in 2012, with a corresponding reduction of the volumes auctioned in 2013 and 2014 by 60 million allowances in each year.

In order to provide a high degree of legal certainty after such a change, the Commission considers it useful to amend the ETS Directive. This is done to clarify in explicit terms that, in order to ensure an orderly functioning of the carbon market, the Commission is in principle able to adapt the auction timetable in the Auctioning Regulation. This amendment of the Directive was proposed by the Commission on 25 July 2012 and Parliament and Council are invited to adopt it urgently. This would allow the Commission swiftly to adopt the amendment to the Auctioning Regulation once it has been approved through the Comitology procedure.

10 What does the change in timing of auction volumes mean for the carbon price and costs for ETS companies?

Impacts are expected to be limited. Without back-loading, market analysts project that allowance prices will fall early in phase 3. The proposed level of back-loading should prevent such a decrease in the short term as volumes auctioned are decreased, and should reduce prices in a limited manner when the auction volumes are increased later in phase 3. But it is not possible to determine with certainty the absolute impact of back-loading on carbon prices over time.

Changes in auction volume are not expected to influence prices beyond those assessed when the revised ETS Directive (3) was adopted as part of the climate and energy package in 2009. Over the longer term, the impact of a back-loaded auction time profile is likely to be limited given that total quantities to be auctioned over the eight-year period do not change. Back-loading will delay the structural build-up of a surplus in the EU ETS but does not address it in a sustainable way.

Direct impacts early on in phase 3 are expected to be limited given that companies in the EU ETS which are exposed to global competition receive free allocation. Not only does the change in the auction time profile not affect the total amount of allowances to be auctioned, it also does not change the amounts of free allocation to these industries. Overall, in recent years these industries have received more free allowances than they have had emissions.

These are, however, aggregate estimates across all industries, and potentially there will be variations between sectors, companies and installations. Certain installations will still have to acquire allowances and will thus be affected. Electricity prices are also expected to increase compared to a situation with no back-loading, but this impact is also seen to be limited. This is partly because back-loading is expected to result in a stabilisation of prices compared to today's levels. Even if carbon prices temporarily increased, it is estimated that the impact on electricity prices would be limited compared to current average prices paid by industry.

11 What does the change in timing of auction volumes mean for Member States' auctioning revenues?

It is estimated that auctioning revenues for Member States would increase early on in phase 3 compared with a situation with no back-loading.

For instance, assuming that the price for allowances would fall to €5 without back-loading, a price of €7 with backloading would mean Member States lost no revenue.

12 What are the main elements of the Carbon Market Report?

The report shows that the EU ETS is a functioning market that has produced an EU-wide carbon price signal that influences daily operational and strategic investment decisions. In 2013 a major revision of the system's operational design will take effect, harmonising the procedures in the ETS across Europe and extending it to cover about half of the EU's greenhouse gas emissions.

Since the economic crisis unfolded in 2008 the ETS has experienced a surplus of allowances which by early 2012 had reached almost 1 billion. This surplus is expected to grow rapidly during the transition from phase 2 into phase 3 due to a number of regulatory provisions (4). By the end of phase 3 in 2020 it could still be around 2 billion allowances.

The rapid build-up in the short term poses a real risk to the orderly functioning of the market. This is why the Commission has put forward the back-loading initiative. However, this short-term measure will not address the surplus in a sustainable manner. For this to happen, structural measures would need to be taken that impact on the balance of supply and demand in the ETS in a more permanent manner. The report sets out a non-exhaustive list of six options for structural measures on which the Commission welcomes stakeholders' views.

13 What are the six options for structural measures that the Carbon Market Report lists?

Option a: This is an option that would increase the EU ETS ambition level in phase 3 in line with an overall 30% greenhouse gas reduction target by 2020 compared to 1990. It would require reducing the overall cap in the ETS in the period 2013-2020 by 1.4 billion allowances. Moving to a 30% greenhouse gas reduction target would also affect the emission targets for sectors outside the ETS (adopted under the Effort Sharing Decision (5)).

Option b: This option would retire a number of allowances in phase 3 on a permanent basis. This measure requires primary legislation but could be implemented by a separate decision, to be taken by the European Parliament and Council, rather than a fully-fledged revision of the EU ETS Directive. As such it would maintain regulatory stability of the wider legislative ETS framework for phase 3.

Option c: The current emission cap in the ETS decreases by a linear factor of 1.74% annually below the average annual total cap for the period 2008-2012. One option would be to change this linear factor, resulting in more ambitious reductions over time. A revision of the linear factor would thus also affect the period beyond phase 3. As such it would also raise questions regarding other important longer term policy questions, such as how to ensure the EU's competitiveness in key low carbon technologies and limit the risk of 'carbon leakage.'

Option d: The ETS could also be expanded to include other sectors, potentially those less strongly influenced by economic cycles which would be beneficial for a stable ETS. This could for instance include expansion to other energy-related CO2 emissions in sectors currently outside the EU ETS. It could have an impact on the overall ambition level, depending on the level of the cap foreseen for the sectors included. How to administer the system most efficiently would need to be addressed.

Option e: The recognition of international credits in the ETS in principle limits compliance costs for businesses. But with emissions being substantially lower than the cap, the volume of international credits allowed in the period 2008 to 2020 has turned out to be rather generous and is strongly contributing to the structural surplus. After 2020 access to international credits could be limited or not allowed. This would create more certainty about the effort to be undertaken in Europe but may impact financial flows and transfer of technology to developing countries. Additional flexibility could be foreseen but only in case of strong and sustained price increases, or as an incentive for stronger action by third countries.

Option f: The EU ETS is designed as a quantity-based instrument, where a predefined quantity of emission allowances – the 'cap' - determines the environmental outcome. This can result in periods of low prices if emissions decrease below the cap. Discretionary price mechanisms could be conceived that would provide some level of price support in such cases, for instance through a price management reserve where allowances are deposited in cases of excessive price decreases. Such mechanisms raise a number of design questions including what the required governance arrangements would be to avoid carbon prices becoming a product of administrative and political decisions rather than a result of market demand and supply.

14 On what basis has the Commission identified the options presented?

The six options are representative of the very different ways that exist to address the structural surplus of allowances. The Commission has made the options concrete in order to allow for a focussed debate with stakeholders.

For instance the options look at:

Demand as well as supply

Not only EU allowances but also interaction with international credits

Action up to 2020 as well as measures affecting the period after 2020

15 Would structural measures apply before 2020?

Yes, but most structural measures would not be ready for deployment before the second half of phase 3. Some would have their full impact only in the next decade. The Commission will therefore also pay close attention to options for structural measures in its work to prepare a climate and energy policy framework for 2030.

16 What are the next steps regarding the Carbon Market Report?

The Commission will actively engage with stakeholders to collect their views on options that would structurally strengthen the ETS. It will shortly launch a formal stakeholder consultation process.

17 What does the proposed two-step approach mean for investment decisions?

Carbon prices are an important element when making investment decisions. They give an EU-wide price signal which can incentivise low carbon investments. The ETS is designed to be technology neutral, cost-effective and fully compatible with the internal energy market.

Rebalancing supply and demand in the carbon market in the short term through back-loading is intended to increase market confidence in the ETS as the key instrument to ensure a gradual low-carbon transformation of the EU economy over the medium and long term. It will partly address stakeholder concerns that the current market situation could potentially lead to a fragmentation of instruments, with some Member States developing national and even sub-national policies at the expense of the transparency that the ETS provides. The electricity sector is for instance a stakeholder supportive of the present decisions in order to facilitate investment decisions in low carbon technologies, including looking at further structural measures.

However, only the deployment of a structural measure would sustainably tackle the over-supply of ETS allowances and thus ensure investor certainty.

Notes

1 : Commission Regulation (EU) 1031/2010 (consolidated version)

2 : Including aviation allowances and 300 million allowances to fund the NER300 programme. This does not take into account any potential reductions in auctioning of allowances for those Member States that would transitionally continue to allocate free allowances to their electricity sector.

3 : Directive 2009/29/EC amending Directive 2003/87/EC so as to improve and extend the greenhouse gas emission allowance trading scheme of the Community

4 : For more information see MEMO "Q&A Emissions Trading: Commission prepares to change the time profile for auctions of emission allowances", 25 July 2012.:MEMO/12/600

5 : Decision No 406/2009/EC on the effort of Member States to reduce their greenhouse gas emissions to meet the Community's greenhouse gas emission reduction commitments up to 2020.

Source: European Commission