Value of production of agricultural products and foodstuffs, wines, aromatised wines and spirits protected by a geographical indication (GI)

04 March 2013by eub2 -- last modified 04 March 2013

This study, financed by the European Commission, was carried out by AND International. The conclusions, recommendations and opinions presented in this report reflect the opinion of the consultant and do not necessarily reflect the opinion of the Commission.

Advertisement

What is a Geographical Indication?

A "geographical indication" (GI) is the name of a product where a given quality, reputation or other characteristic of the good is essentially attributable to its geographical origin. It is a type of intellectual property right that can apply in the EU to different types of products.

4 schemes

EU legislation provides for protection of GIs in respect of:

Wines (1): started in the 1970s as part of the common market organisation (CMO) of wine, the system was amended in 2008 in the context of the wine reform, to adopt the principles of legislation on agricultural products and foodstuffs.

Spirits (2): an EU system was also created in 2008 following reform of the rules on definition, description, presentation, labelling and protection of geographical indications of spirit drinks. Prior to this, names were listed and protected in the spirit drinks legislation.

Agricultural products and foodstuffs (3): a harmonised regulatory framework for GI registration in the EU was created in 1992. The system has been modified recently (see section below "What has changed with the new Quality Regulation?").

Aromatized wine products (4): A new harmonised regulatory framework is currently under discussion.

PDO and PGI

Protected Designation of Origin (PDO): The name of a product that is produced, processed and prepared in a defined geographical area using recognized know-how. Products owe their characteristics exclusively or essentially to their place of production and the savoir faire of local producers.

Protected Geographical indication (PGI): Product whose reputation or characteristics is closely linked to production in the geographical area. For PGI agricultural products and foodstuffs, at least one of the stages of production, processing or preparation takes place in the area. For PGI wines, at least 85% of the grapes come from the area.

Protected Geographical indication (PGI): Product whose reputation or characteristics is closely linked to production in the geographical area. For PGI agricultural products and foodstuffs, at least one of the stages of production, processing or preparation takes place in the area. For PGI wines, at least 85% of the grapes come from the area.

Which are the benefits of GIs?

Consumer benefits

Quality assurance: the consumer is assured he is buying a genuine product with specific qualities

Producer benefits

Open system: the use of the GI name is open to all producers complying with the product specification (contrary to the trade mark system limiting the use of a trade mark name to the owner of the trade mark)

Fair competition: only producers complying with the specification may use the name

Protection: the use of the name on the market place is controlled by the Member States control authorities

Price premium: the study showed that GI products are sold (in average) 2.23 times as high as a comparable non-GI products

Promotion: GI producers may benefit from EU promotion funds for quality products

Societal benefits

Link valuable products to rural areas: production cannot be delocalised to another area

Reconnect consumers and producers

Protect traditions

Environmental benefits

Linking traditional products with landscapes and farming systems

How many names are registered?

The study took in account the 2768 EU names that were registered as GI on the 1st of January 2010.

Number of GIs by scheme in 2010 (Source: DG AGRI))

Number of GIs by scheme in 2010 (Source: DG AGRI))

The most recent overview of registered names can be found in the following databases:

wines: consult the "E-Bacchus" register: http://ec.europa.eu/agriculture/markets/wine/e-bacchus/

agricultural products and foodstuffs: consult the DOOR database http://ec.europa.eu/agriculture/quality/door/list.html

spirits: consult the "E-SPIRIT-DRINKS" database: http://ec.europa.eu/agriculture/spirits

What is the value of EU GIs?

by scheme

Sales value by scheme in the EU-27 in 2010

image 4 Sales value by scheme in the EU-27 in 2010

over the years

Sales value by scheme in EU 27 between 2005 and 2010 (M€)

|

|

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

% 2010 |

|

Wines |

27 963 |

28 900 |

30 884 |

31 363 |

29 025 |

30 376 |

55.9% |

|

Agri. prod. and foodstuffs |

13 284 |

13 457 |

13 891 |

14 238 |

14 525 |

15 790 |

29.1% |

|

Spirits |

7 168 |

7 555 |

8 101 |

7 793 |

7 126 |

8 149 |

15.0% |

|

Aromatised wines |

31 |

31 |

31 |

31 |

31 |

31 |

0.1% |

|

Total |

48 446 |

49 943 |

52 907 |

53 425 |

50 707 |

54 346 |

100% |

Source: AND-International survey for DG AGRI

in the total food and drinks industry

GI sales value accounted for 5.7% of the EU food and drinks industry in 2010. The Member States with the highest share of GI in the national food and drink industry had a long tradition of GI and/or a large share of wine or spirits in the total GI sales value.

Share of national GIs in the sales value of the national food and drink industry

Based on AND-international survey for DG AGRI

and FoodDrinkEurope (for the value of national food and drink industry)

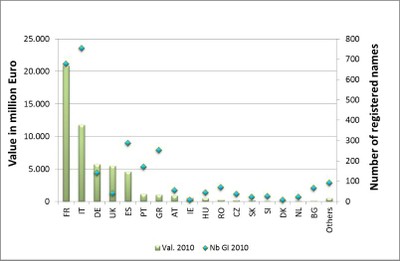

by countries of production

Source: AND-International survey for DG AGRI

by category

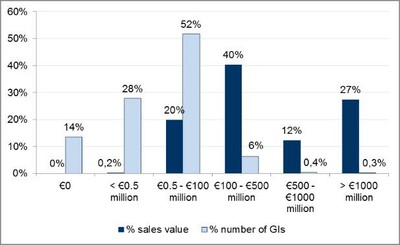

The average sales value for a registered GI was €19.7 million and 50% were over €1.1 million. The seven GIs over €1 billion gathered 27% of the EU sales value, however, no sales had been identified for 14% of the GIs in 2010.

This shows that some "success stories" may be reported, some GIs being major actors in the food chain. It also shows that small producers also benefit from the system.

% sales value and % of GIs by category of size (2010)

Source: AND-International survey for DG AGRI

by destination

In 2010, exports of GI products out of the EU 27 represented around 15% of all extra-EU food and beverages exports. The United States had by far the largest share of these, with €3.4 billion of imports of EU GI products (30% of total food and beverages imports from the EU 27). Switzerland, Singapore and Canada came next, with €839 million, €829 million and €729 million respectively.

The overall structure of trade had been fairly stable between 2005 and 2010. The domestic market remained the most important market for GI products with 60.1% of the total sales value, while intra-EU trade reached 20.4% and extra-EU trade 19.5%.

Sales value of GI products by destination in 2010

Source: AND-International survey for DG AGRI

How many more GI applications are pending?

The interest from producers to register product names as a GI remains high. At the end of February 2013, a number of 285 applications are pending for agricultural products and foodstuffs.

Pending applications for GI agricultural products and foodstuffs (as of 21.02.2013)

Source: DG AGRI

In the wine sector, Member States have submitted to the Commission by 31 December 2011, 1.561 technical files related to existing GIs. The Commission is still examining those files. Furthermore, five applications for new wine PDOs are currently pending.

In the spirits sector, Member States have to submit to the Commission technical files related to established GIs by February 2015. Four applications for new spirits GI of third countries are currently pending.

What has changed with the new Quality Regulation?

On January 3 2012, the new regulation on quality schemes for agricultural products and foodstuffs entered into force. The main novelties introduced for GIs agricultural products and foodstuffs include:

- Faster registration procedures

- Rules on controls clarified

- Clarification on protection: applies when product is used as ingredient

- Role of producer groups recognised

- Scope extended to leather, feather and fur

- Possibility for third country GI in bilateral agreements to use the PDO/PGI logo

- Legal basis for financing the defence of the EU logo established

Further information

More info on the study

Notes

(1) : Wines - Regulation (EC) No 1234/2007

(2) : Spirits - Regulation (EC) No 110/2008

(3) : Agricultural products and foodstuffs – Regulation (EU) No 1151/2012

(4) : Aromatized wine products - Regulation (EEC) No 1601/91

Source: European Commission